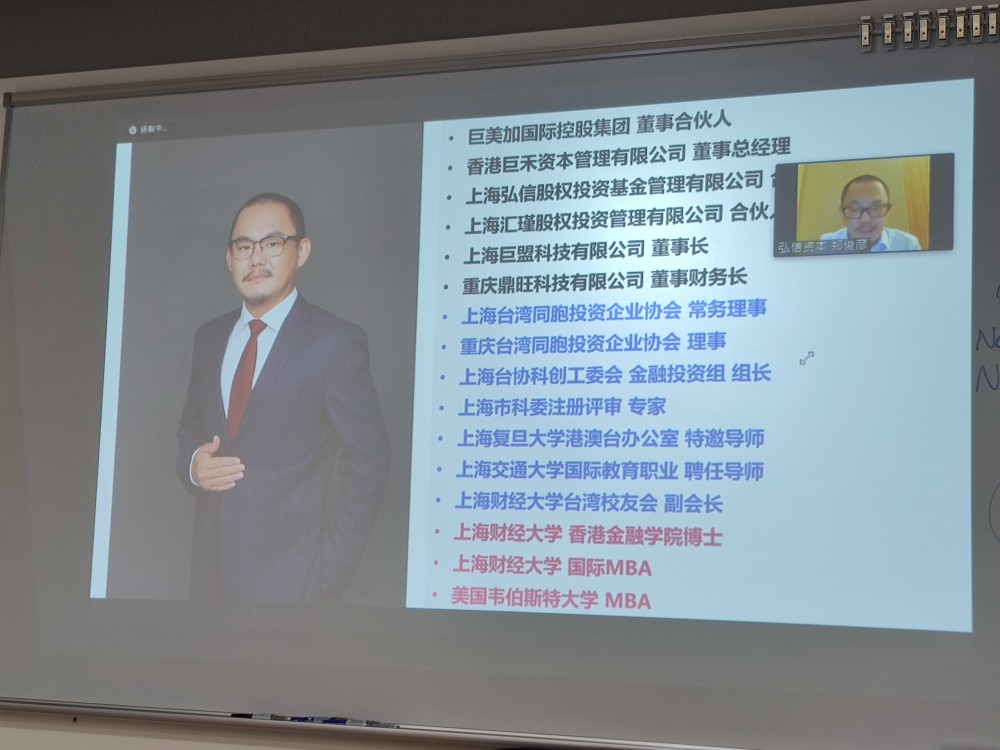

On 16 March 2023, the Faculty of Finance of the City University of Macau held the Finance Seminar Series [21] at Golden Dragon Campus. Mr. Junyan Zheng, director and partner of Kechuang Finance Group of Shanghai Hongxin Equity Investment Fund Management Co., Ltd., and executive director of Shanghai Association of Taiwan Compatriots Investment Enterprises, was invited to deliver a speech titled “Corporate Acquisitions and Mergers”.

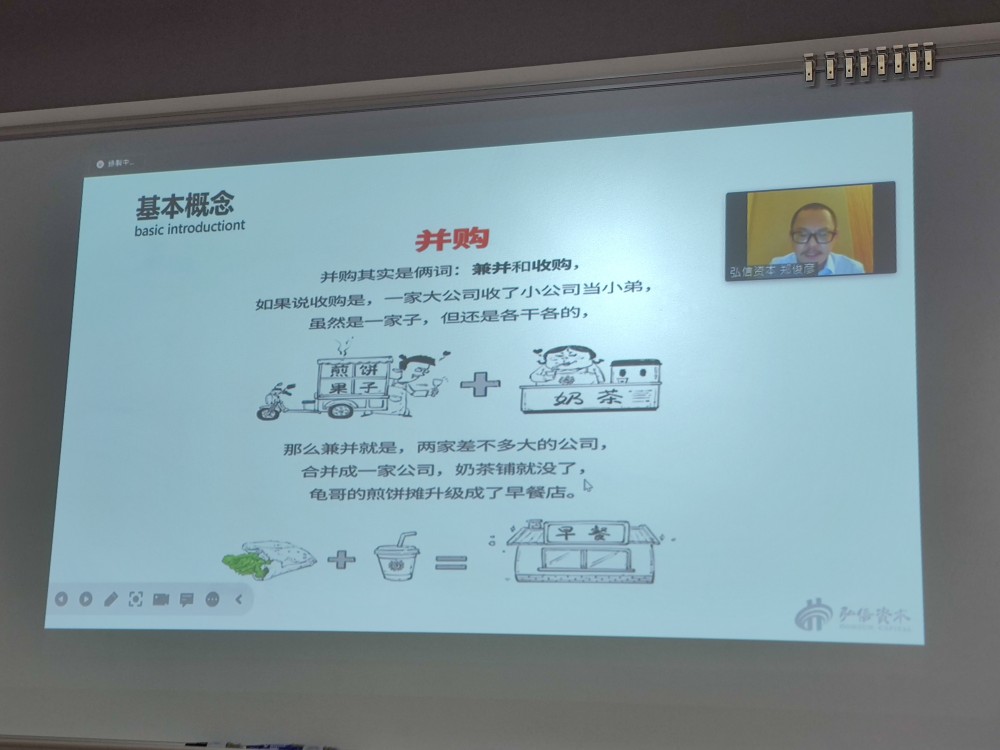

Mr. Zheng first introduced the basics of merger and acquisition(M&A), including the types, purposes, stages, payment methods, legal and other considerations, risks, valuation methods and the importance of cultural integration. M&A refers to the decisions of enterprises to expand scale, improve efficiency or realize strategic layout by acquiring or merging assets, shares or businesses of other enterprises. The purpose of M&A includes scale economy, market power effect, saving transaction costs and diversified development. It starts from searching and investigating the target enterprise, conducting preliminary negotiations, writing the investigation report of the target enterprise, signing the letter of intent for M&A, evaluating assets, determining the transaction price, signing the M&A agreement, liquidation and legal procedures, and issuing the announcement of M&A.

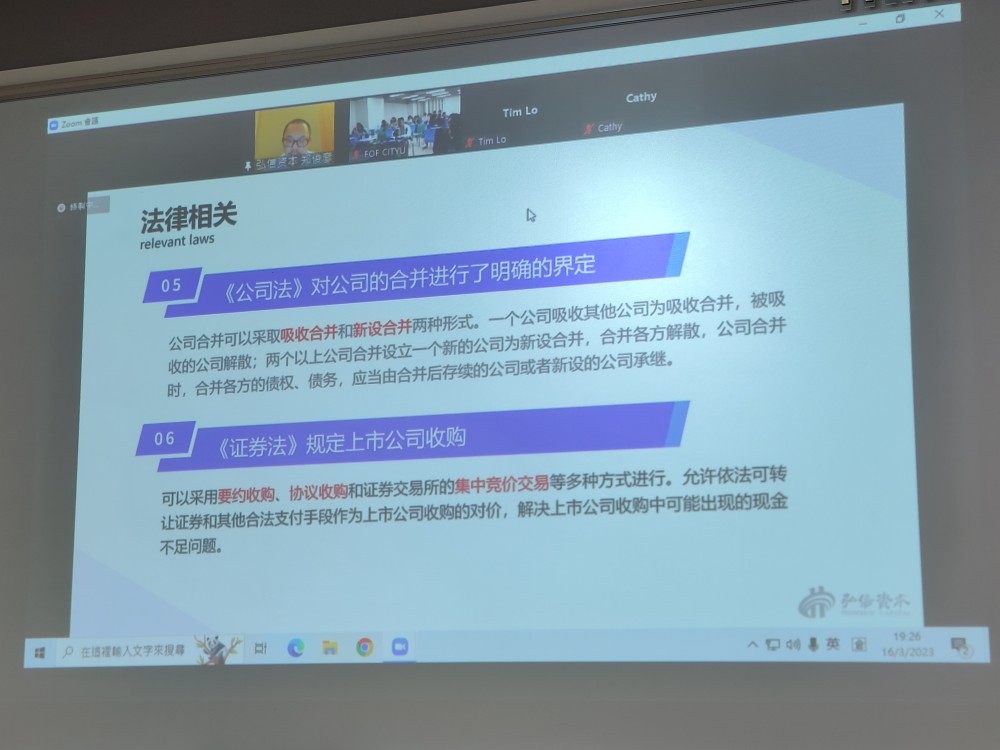

Then, Mr. Zheng shared various payment methods for M&A, including cash purchase of assets, cash purchase of shares, stock purchase of assets, stock exchange, debt-to-equity conversion, indirect holding, debt-to-M&A, free transfer, etc. He reminded students that M&A needs to pay attention to legal matters such as checking debts, operating conditions, annual reports and audit reports, and pointed out that M&A has different risks including financing, false assets, anti-takeover, operation and resettlement of employees of the acquired company. He also explained the mainstream valuation methods of M&A in the market, including cost method, market method and income method. The people involved in M&A include the company's project teams, accountants, lawyers, investment banks and other advisers. The most difficult problem in M&A is cultural integration, including the differences between the two parties in terms of the enterprise system, organization, mechanism and culture.

Mr. Zheng introduced merger waves, leveraged buyouts and cases of TCL Corporation. Since 1897, TCL has experienced the merger wave seven times: horizontal M&A, vertical M&A, conglomerate merger, leveraged buyout, strategic M&A, Internet high-tech M&A and theme-based diversification cross-industry M&A. Starting from the reform and opening up, China's M&A wave has experienced four stages: embryonic exploration, faltering start, explosive growth and rational development. Leveraged buyout refers to the acquisition of the target company's assets and future cash flow as collateral for financing to obtain the greater part of the acquisition capital, up to of 70% to 80%. There are three main sources of financing for acquisitions: private capital, senior debt and subordinated debt. Management buyout is the acquisition with the participation of the management of the target company. It has the characteristics of unique formation background, favorable purchase price, diversified acquisition target, relative acquisition and externality of leverage. TCL Corporation is engaged in the research, development, production and sales of household appliances, information and communication products. Through the introduction of strategic investors, the company has changed from a wholly state-owned company to a diversified company with shareholders.

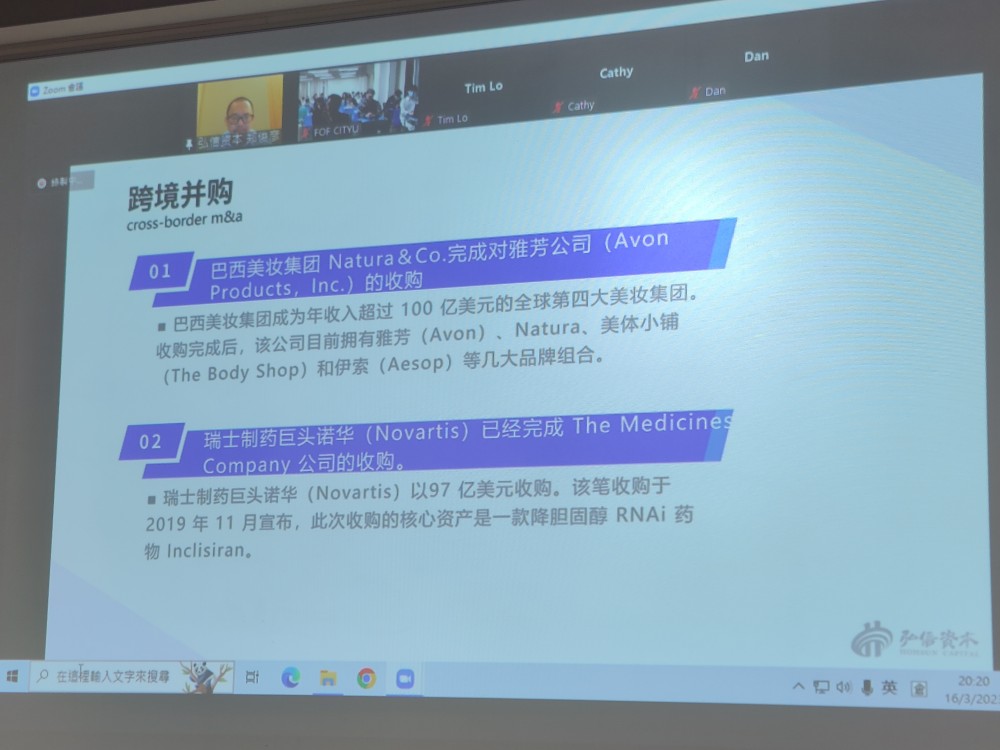

Lastly, Mr. Zheng briefly introduced Foxconn Technology Group (Taiwan) 's acquisition of 66% of Sharp (Japan), and analyzed the four motivations for the acquisition. They are acquiring core technology and improving profit margin; Balanced management to get rid of over-dependence on a single customer; Taking advantage of Sharp's brand; And a history of good cooperative relationship between the two companies. Mr. Zheng went on to share in detail the M&A process of a real case recently completed, which benefited the students a lot.

At the end of the sharing, the students took this valuable opportunity to actively pose questions, and Mr. Junyan Zheng answered in detail. The Seminar helps students to learn more about the process and mechanism of enterprise merger and acquisition, and have an in-depth understanding of its purpose and advantages. The students also expressed their expectations for the finance seminars in the coming semester.