On 1 December 2022, the Faculty of Finance of the City University of Macau held the Finance Seminar Series [13] at the Royal Campus. Mr Tou Lok, Managing Director of Zhukuan (Macao) International Financial Leasing Company Limited, was invited to deliver a speech titled “Current Situation and Prospect of Financial Leasing Industry in Mainland China and Macao”.

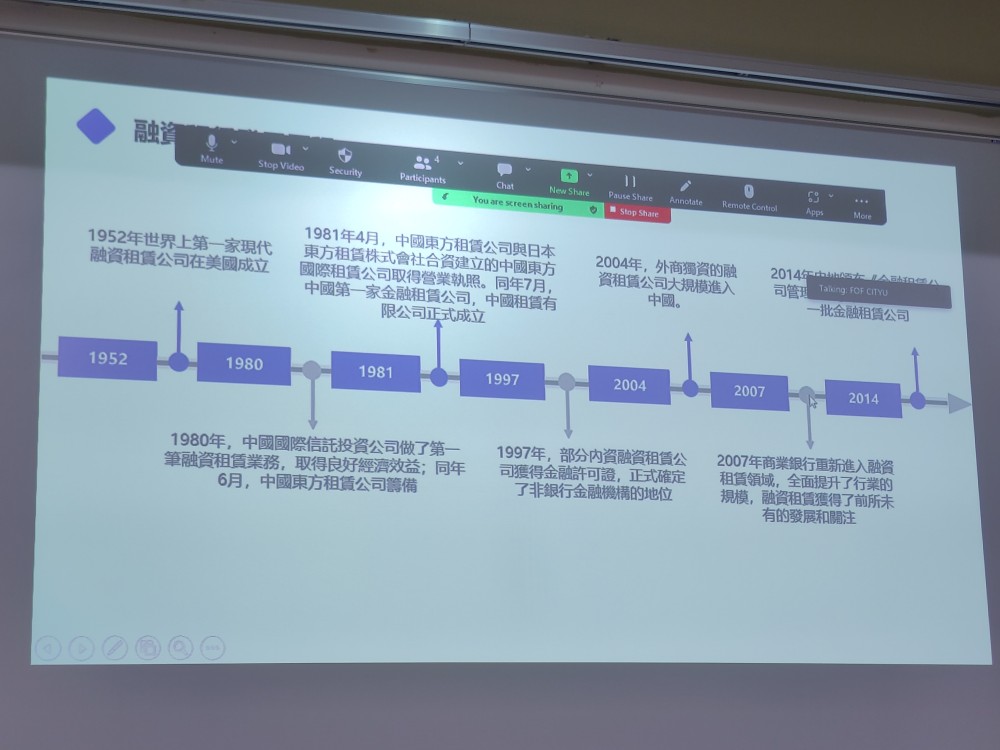

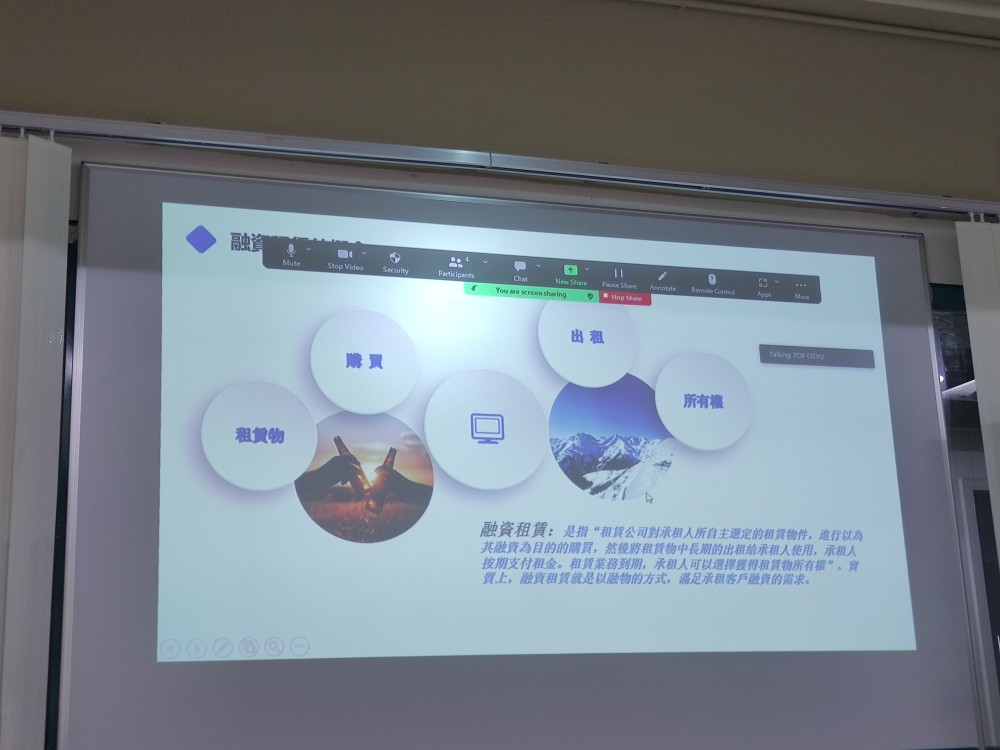

To begin with, Mr Lok explained the origin and history of financial leasing. Financial leasing is a way to meet the financing needs of tenants. In 1952, the world's first modern financial leasing company was established in the United States. In 1980, China International Trust and Investment Corporation did the first financial leasing business and achieved good economic benefits. In June of the same year, China Eastern Leasing Company made preparations. In April 1981, China Oriental International Leasing Corporation, a joint venture established by China Oriental Leasing Corporation and Japan Oriental Leasing Corporation, obtained the business license. In July of the same year, China Leasing Co., Ltd., the first financial leasing company in China, was officially established. In 1997, some domestic-funded financial leasing companies obtained financial licenses, which officially defined the status of non-bank financial institutions. In 2004, foreign-owned financial leasing companies entered China on a large scale. In 2007, commercial banks re-entered the financial leasing field, comprehensively improving the scale of the industry, and financial leasing gained unprecedented development and attention. In 2014, the mainland promulgated the Measures on the Administration of Financial Leasing Companies, and began to examine and approve the establishment of a number of financial leasing companies.

Mr Lok introduced the current situation and prospects of the development of financial leasing in the mainland. Mainland financial leasing companies can be divided into three main categories. Domestic-funded financial leasing companies are currently supervised by the financial bureaus of local governments, whose shareholders are all large enterprise groups in the mainland. Besides capital, the main source of funds is bank loans, and their relationship with banks is defined as general enterprise; Approved and supervised by China Banking and Insurance Regulatory Commission, the financial leasing company is a non-bank financial institution, which is difficult to establish and has high requirements from shareholders and supervision. Besides capital, it can also absorb shareholders' deposits, inter-bank borrowing, inter-bank borrowing, and issue financial bonds. The financing cost is low, and its relationship with banks belongs to the financial industry; Foreign-invested financial leasing companies are currently supervised by the financial bureaus of local governments, and its shareholders are all large foreign-funded enterprises, including Hong Kong, Macao and Taiwan. Besides capital, the main source of funds is bank loans, and its relationship with banks is positioned as general enterprise. The pandemic has a great impact on the normal operation of financial leasing enterprises, and China's financial leasing industry is still faced with great challenges in the face of complex and severe domestic and international economic situations. Medium and large financial leasing enterprises bear greater pressure at the asset end, while small and micro financial leasing enterprises bear greater pressure at the capital end. The overall business risks of the industry are under control, and no obvious external financial risks are found. The ability of financial leasing enterprises to resist risks is gradually enhanced.

Then Mr Lok introduced the current situation and prospects of financial leasing in Macao. With the advantages of one country, two systems, backed by the mainland, the central government's support for Macao's industrial diversification and the strong support of the two governments of Macao, the financial leasing industry in Macao is in its initial stage. The local government has provided finance leasing companies with many practical tax incentives, including exemption from paying stamp duty and stamp duty of real estate property transfer. The Macao government has also introduced a number of legal supports for the finance leasing industry, as well as the introduction and training of characteristic financial talents and the Second Five-Year Plan. The pandemic has had a great impact on the normal operation of financial leasing enterprises. Facing the complex and severe domestic and external economic situation, Macao's financial leasing industry is still facing huge challenges. Macao financial leasing companies face great pressure in terms of financing costs. The overall scale of the industry is too small and needs to be further expanded. It is of great significance for the development of the industry to strengthen the popularization of financial leasing business knowledge among Macao enterprises.

Lastly, Mr Lok introduced Zhuguang (Macao) International Financial Leasing Co., Ltd. To the students. Zhuguang (Macao) International Financial Leasing Co., Ltd. is the first and only financial leasing company in Macao. Looking forward to the future, Zhuguang (Macao) Leasing will have the advantage of dual licenses in Macao and Zhuhai. On the one hand, it will give full play to the role of Macao as a window to connect with Portuguese-speaking countries and attract overseas low-cost funds. On the other hand, it will closely follow the construction plans of Guangdong-Hong Kong-Macao Greater Bay Area and Hengqin Guangdong-Macao In-depth Cooperation Zone, and strive to build a high-quality international financial leasing company with industry focus and deep development in the Bay Area.

At the end of the sharing session, the students took this valuable opportunity to actively pose questions related to financial leasing, and Mr Lok answered in detail. In the Seminar, students paid attention to the development and prospect of Macao’s financial leasing for the internationalization of RMB, and gained a lot knowledge through the financial seminar series. The students also expressed their expectations for the sharing of the next finance seminar.