On November 16, 2023, the Faculty of Finance at City University of Macau 10th installment of its Finance Seminar Series at the Ho Yin Convention Center. The distinguished guest speaker for this seminar was Jane Li, a lawyer from Beijing Docvit Law Firm, who shared insights on the topic "In-depth Analysis and Strategic Discussion: Understanding the Uniqueness of Aircraft Financing Leases" through online participation.

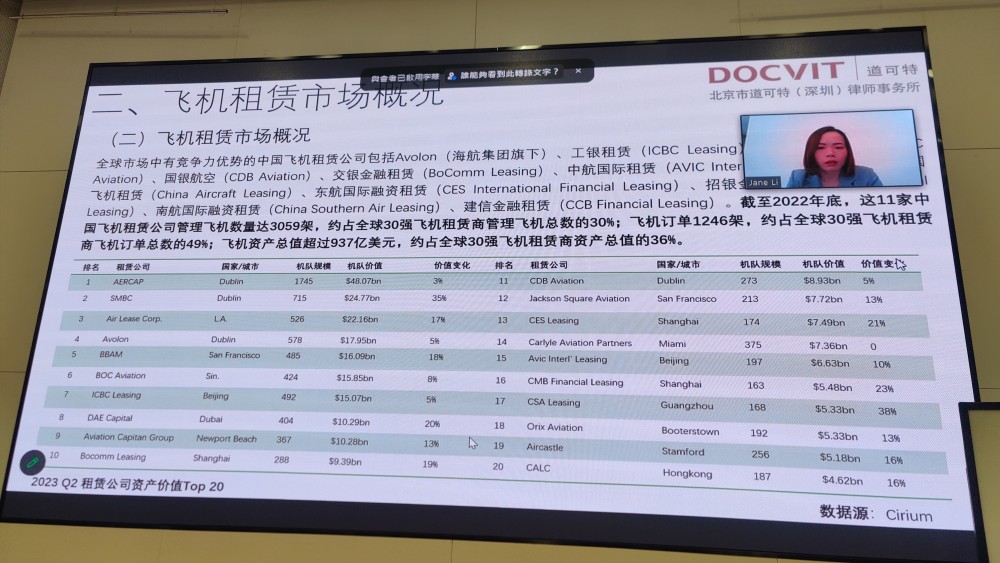

Jane Li, as the first part of her presentation, introduced the concept, definition, and historical development of aircraft leasing. She emphasized the broad scope, large investment amounts, and long transaction cycles involved in aircraft leasing, explaining the functional characteristics of aircraft leasing from both macroeconomic and microeconomic perspectives. Despite the significant impact of the previous years' pandemic, the aircraft leasing market has exhibited robust and steady growth globally, with increasing demand and a particular focus on the future market needs in Southeast Asia, especially in the Chinese region.

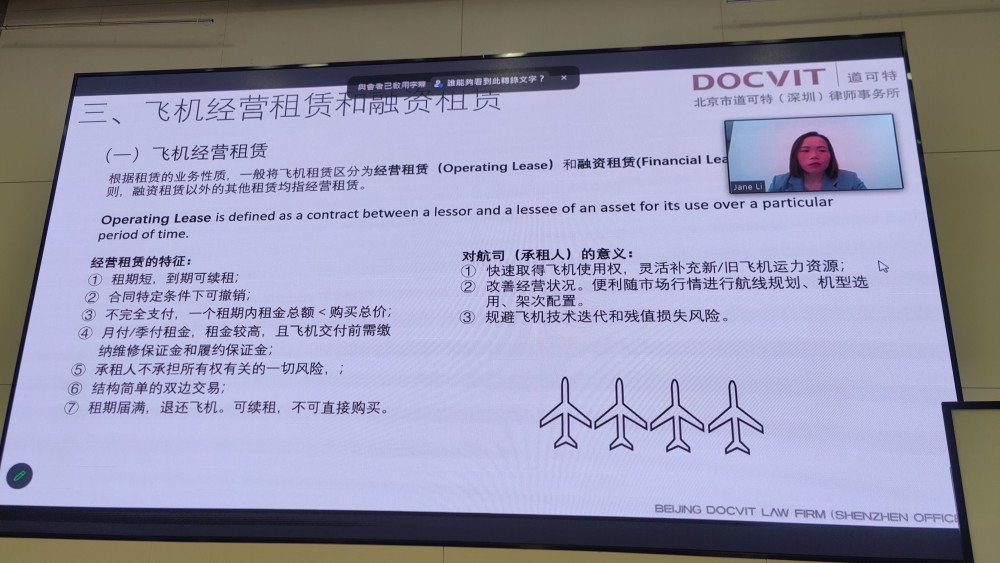

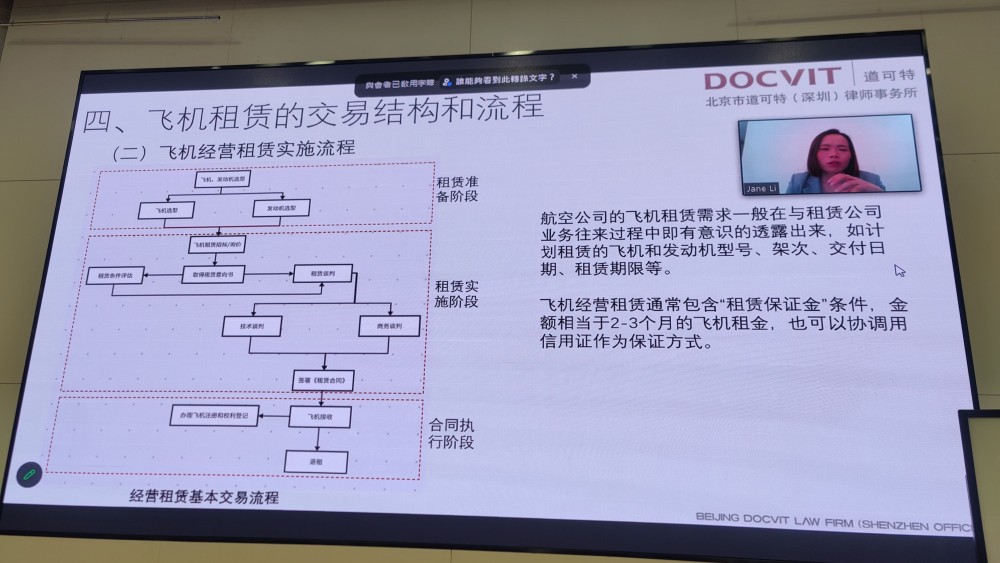

Next, Jane Li explained the various methods of aircraft leasing, providing detailed classifications based on nature, scope, financing sources, and payment themes. There are multiple financing channels available for aircraft leasing, with secured and unsecured loans being the primary sources. Based on the operational nature of the lease, aircraft leasing is generally categorized into operating leases and financial leases. Operating leases are relatively straightforward and usually include a "lease deposit" condition, typically equivalent to 2-3 months of aircraft rent, with the option to employ a letter of credit as well. On the other hand, aircraft financial leasing serves both financing and physical leasing purposes. Its most distinctive feature is that the lease term aligns with the aircraft's operational period, with the lessor bearing all costs and risks associated with the aircraft during the lease term, while legal ownership of the aircraft remains with the lessor, and the lessee holds the economic rights of use. Aircraft financial leasing effectively transfers all risks and returns related to the leased asset to the lessee.

Jane Li also shared the advantages and disadvantages of aircraft leasing from the perspectives of lessees, lessors, and external factors. Additionally, she presented risk control mechanisms that can be implemented to mitigate or reduce potential risks.

Finally, Jane Li showcased some case examples of operating leases, providing students with a more intuitive understanding of the important considerations throughout the contract process. It is worth noting that aircraft leasing contracts include the concept of "quiet enjoyment," whereby the lessor cannot arbitrarily interfere with the lessee's use of the aircraft.

Jane Li's presentation provided students with a deeper understanding of aircraft financing leasing. During the subsequent Q&A session, Jane Li addressed students' questions and concerns, encouraging active discussion and reflection. The City University of Macau expresses gratitude to Jane Li for her excellent presentation and looks forward to the next finance seminar.