.jpg)

On May 28, 2024, the academic exchange conference between the International School of Business & Finance of Sun Yat-sen University and the Faculty of Finance of City University of Macau was successfully held. Professor Adrian Cheung, the dean of Faculty of Finance along with Professor Zhou Yonghong, Associate Professor Yang Ting, Associate Professor Lou Shiyan, Assistant Professor Zhang Yan, Assistant Professor Li Meng, Assistant Professor Liu Lu, Assistant Professor Deng Lin, Assistant Professor Ling Yun, led a group of students to International School of Business & Finance of Sun Yat-sen University for academic exchange. Faculty and students from both universities engaged in discussions on the latest research papers.

.jpg)

Before the conference began, Professor Huang Xinfei, the dean of Sun Yat-sen University’s International School of Business & Finance, delivered a speech warmly welcoming the faculty and students from City University of Macau’s Faculty of Finance. He expressed the hope for continued academic exchange and collaboration between the two institutions. Following that, Professor Adrian Cheung, the dean of City University of Macau’s Faculty of Finance, also gave a speech, emphasizing the friendly exchange between the two schools. A commemorative pennant presentation ceremony took place afterward.

.jpg)

The first session of the seminar was chaired by Professor Zhang Li from Sun Yat-sen University’s International School of Business & Finance. First, Assistant Professor Li Meng from City University of Macau presented a paper titled “Annuity and Estate Taxation.” The study quantified the impact of inheritance tax on annuities using a two-period model and analyzed the effects of substitution and income on annuities. Next, Assistant Professor Zhang Chi from Sun Yat-sen University’s International School of Business & Finance reported on his latest research regarding ESG disclosure requirements in host countries and cross-border mergers and acquisitions by Chinese companies. The study used a dynamic difference-in-differences (DID) model and found that mandatory ESG disclosure requirements in host countries can enhance Chinese companies’ cross-border acquisitions by reducing information asymmetry.

.jpg)

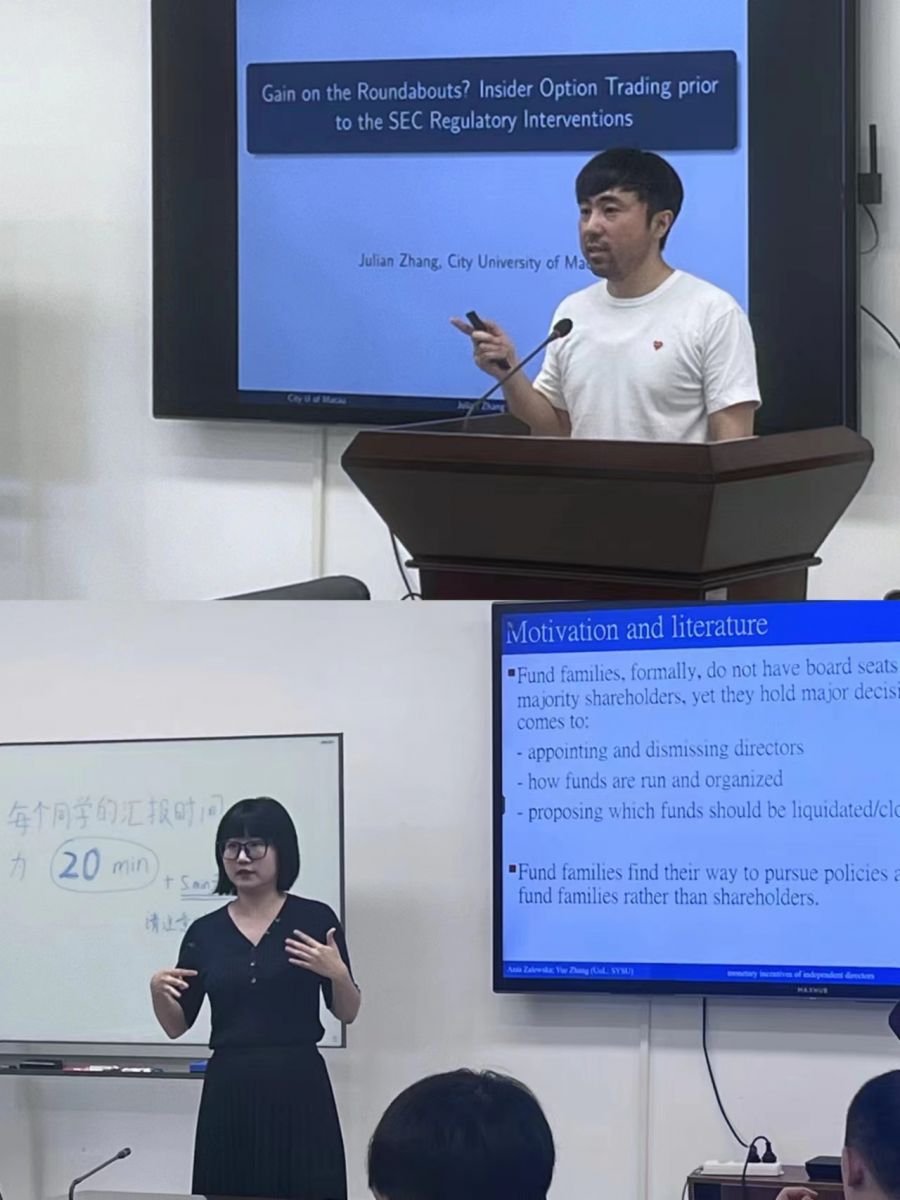

After the lunch break, the second session of the seminar began, moderated by Professor Zhou Yonghong, the director of the doctoral program at City University of Macau’s Faculty of Finance. The first presenter was Assistant Professor Zhang Yan from City University of Macau, who discussed “Gain on the Roundabouts? Insider Option Trading prior to the SEC Regulatory Interventions.” The paper explored the relationship between AAER (Accounting and Auditing Enforcement Releases) and abnormal trading by the U.S. Securities and Exchange Commission (SEC), finding consistency with the investigation of potential insider option trading. Following that, Assistant Professor Zhang Yue from Sun Yat-sen University’s International School of Business & Finance presented “The effectiveness of monetary incentives of independent directors in retail and institutional mutual funds.” The study examined whether the compensation structure of independent directors (cash compensation vs. stock ownership) enhances their independence in U.S. mutual funds.

The third session, chaired by Associate Professor Xu Jing from Sun Yat-sen University’s International School of Business & Finance, featured Associate Professor Lou Shiyan from City University of Macau as the first presenter. Her paper, titled “The Impact of Education on Happiness: Moderating Effects Based on Migration Experience,” analyzed how education levels influence happiness among people with different migration experiences. Associate Professor Lin Zhifan from the Institute of Advanced Studies in Humanities and Social Sciences at Beijing Normal University then discussed “How to Measure China’s Financing Constraints: Reflection on Existing Methods and Indicator Reconstruction.” His study summarized previous research and compared five different measures of financing constraints, proposing a new indicator based on text analysis. Finally, doctoral student He Haonan, who graduated from Sun Yat-sen University, presented “Digital Financial Infrastructure and Inclusive Financial Development: An Empirical Study Based on Receivables Financing.” Using a DID model, the research found that the People’s Bank of China’s receivables financing service platform improved the pledge financing scale for small and medium-sized enterprise suppliers, demonstrating that digital infrastructure automation supports high-quality development in inclusive finance.

.jpg)

The rich content of this seminar facilitated intense discussions and exchanges among teachers and students from both universities, broadening their horizons and fostering camaraderie. The successful conference laid a solid foundation for friendly development between City University of Macau and Sun Yat-sen University, and both sides look forward to future collaborative exchanges.