On 11 May 2023, the Faculty of Finance of the City University of Macao held the Finance Seminar Series [32] Well Link Finance Forum at the Ho Yin Convention Centre. Mr. Vincent Cai, Executive Director and Vice President of Well Link Bank, was invited to deliver a speech titled “Wealth Management in Macau”. Guests attending this seminar include Dean Adrian Cheung and Associate Dean Eva Khong, City University of Macau.

Mr. Cai first explained the creation and distribution of wealth. In recent years, with the rapid development of artificial intelligence technology, AI-generated Content (AIGC) represented by ChatGPT has become a hot topic. This technology not only brings users richer and more creative content, but also constantly opens up application scenarios of all walks of life, thus giving birth to new industries and creating great wealth. Through sensing, analyzing and generating data, AIGC technology helps enterprises make accurate decisions in business decision-making, product research and development, marketing and other aspects to create more value, and also brings business opportunities for various industries, such as digital art, intelligent manufacturing, smart city and other fields, and will become an important industrial sector in the future. AI technology will play an increasingly important role in creating more wealth and job opportunities, and Mr. Cai expressed his expectation that AIGC technology can promote the sustainable development of society while realizing its own business value.

Mr. Cai stated that the wealth management market in Macau is diversified and innovative, providing investors with more choices and opportunities, and the wealth management market in Macau has grown rapidly in recent years, attracting many international financial institutions. Financial institutions in Macau include banks, insurance institutions and other non-bank financial institutions, providing customers with a diverse range of financial products and services. In terms of insurance, consumers can buy insurance products including critical illness insurance, life insurance, savings insurance and high-end medical insurance, and insurance institutions also introduce special insurance products, such as policy financing loans, so that customers can use the cash value of the policy to obtain loans. Macau's securities products include stocks, bonds, hybrid funds, ETFs, as well as specialty securities products, such as monthly mortgage stocks and margin financing. In terms of mutual funds, investors can choose from equity funds, bond funds, hybrid funds and money funds. The fund market in Macau is still growing and improving, providing clients with more investment options. In terms of banking, banks in Macau provide a wide range of deposit, loan, investment and foreign exchange trading services, as well as foreign exchange margin, gold deposit and bond investment and other special products.

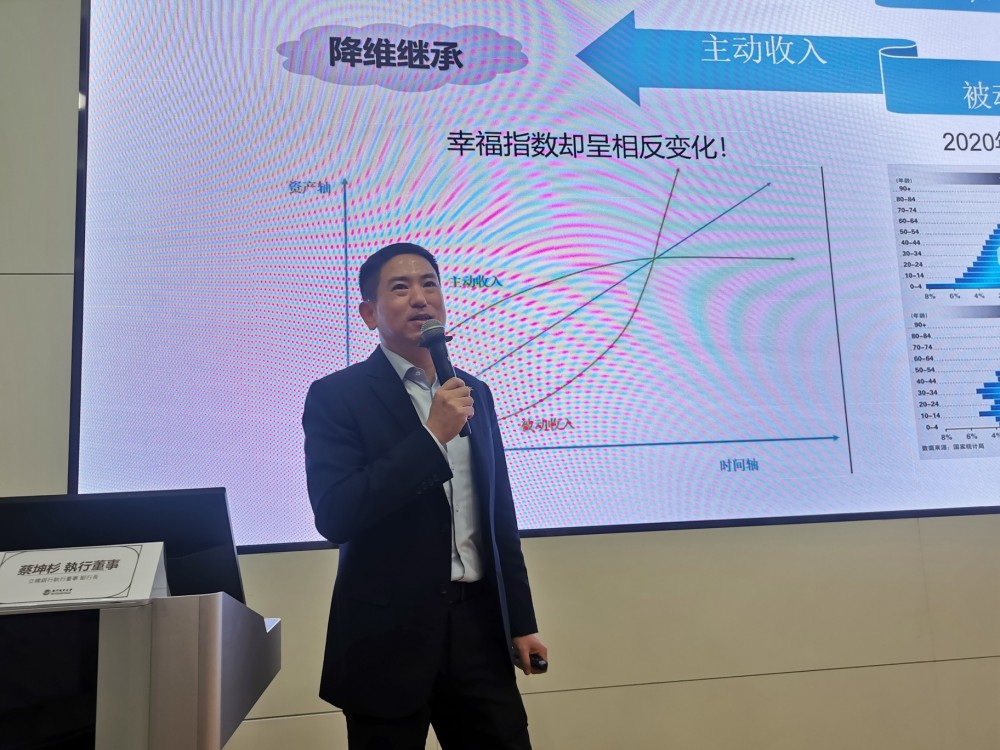

Then, Mr. Cai explained asset allocation. Asset allocation focuses on asset allocation and wealth planning according to different risks, and actively explores how to achieve the goal of wealth appreciation and preservation through intelligent investment methods. Asset allocation and wealth planning are crucial for individuals or families. Successful asset allocation takes into account a variety of factors such as an individual's or family's risk tolerance, income level, financial goals, and changes in the global economic environment. Investment advisers and financial institutions play an important role in tailoring asset allocation and wealth planning solutions tailored to the individual or family's specific circumstances to help them achieve their financial goals, reduce risk and maximize returns. As the global economy becomes more complex and international tax and wealth management laws and regulations become more stringent, investing in this environment requires a full understanding of and compliance with relevant laws and regulations. For people who want to conduct asset allocation and wealth planning, the most important thing is to find a trustworthy investment adviser and financial institution, on the basis of understanding their own risk tolerance and financial goals, to work out an effective investment plan to achieve a win-win situation of wealth appreciation and preservation.

With the advancement of economic globalization, the banking industry in Macau is experiencing unprecedented changes and challenges. In recent years, it has made remarkable achievements and begun to integrate with the world, becoming an indispensable part of the international financial market. Located between China and Portuguese-speaking countries, Macau has a diversified financial culture and advantages, which has become an important cornerstone for Macau's banking industry to meet international challenges. In the operation of the financial industry, words such as leverage, penetration and mismatch have become keywords, which not only require financial institutions to carry out adequate risk assessment and control, but also require the guidance and supervision of industry regulators. Mr. Cai then introduced that Well Link Financial Group has diversified financial services and cross-border layout, and Well Link Bank with its full license commercial bank qualification, has established seven branches in Australia, the future will also expand to Hengqin, Hong Kong and other places. Lastly, Mr. Cai concluded that the Macau banking industry is actively responding to the trend of internationalization and globalization, and promoting the development of the industry by strengthening risk control and innovative financial products. With the continuous evolution of the financial industry, the banking industry in Macau will continue to innovate, expand the international market, and help the rise of China's financial industry.

At the end of the sharing session, students took this valuable opportunity to actively pose questions related to the wealth management market in Macau, and Mr. Cai answered in detail. In the Seminar, students paid attention to asset allocation and wealth planning, and gained a lot through the financial seminar series. The students also expressed their expectations for the sharing of the next finance seminar.