On the afternoon of October 16, 2025, to continuously promote industry-academia collaboration and enhance the integration of theoretical knowledge with practical application, doctoral students from the Faculty of Finance of the City University of Macau visited the headquarters of Well Link Bank for an exchange and learning session. Attendees included Ms. Joana Leong, Regional Director and Mr. Lo Kit Sang, Deputy General Manager of Well Link Bank, as well as Dean Adrian Cheung and Associate Dean Eva Khong of the Faculty of Finance.

Mr. Lo Kit Sang, Deputy General Manager of Well Link Bank, possesses over 49 years of experience in the banking industry, having previously held important positions such as Senior Financial Management Manager at Bank of China (Hong Kong) and General Manager of the Finance Department at Nanyang Commercial Bank (China). He also holds professional qualifications including Fellow of the Institute of Public Accountants (FIPA), Fellow Financial Accountant (FFA), Fellow of the Association of International Accountants (FAIA), and the Senior Technician (Level 1) in Financial Management certification issued by the Chinese Ministry of Human Resources and Social Security.

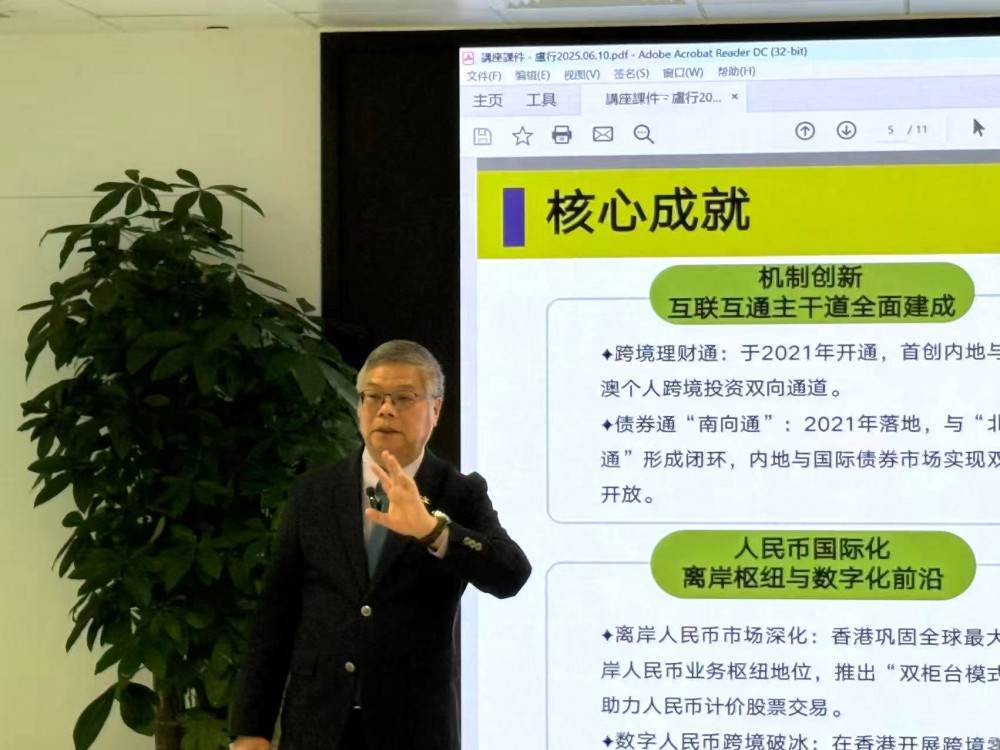

During this exchange, Mr. Lo, drawing on his extensive practical experience, provided an in-depth analysis of cross-border finance in the Greater Bay Area (GBA), systematically dissecting the development landscape of cross-border finance in the Guangdong-Hong Kong-Macao Greater Bay Area. Mr. Lo first elaborated on the strategic positioning of cross-border finance in the GBA. He detailed several interconnectivity mechanisms, including:

- Wealth Management Connect: Launched in 2021, it pioneered a two-way channel for personal cross-border investment between the Mainland, Hong Kong, and Macao.

- Bond Connect: Includes Northbound trading and Southbound trading, launched in 2021, achieving two-way opening of the bond market between the Mainland and international markets.

- ETF Connect: Similar to the Stock Connect schemes, covering both Northbound and Southbound trading.

- Swap Connect: Allows overseas investors to participate in the financial derivatives market through the connection between Hong Kong and Mainland institutions.

He particularly highlighted the Memorandum of Understanding on Cross-border Payment Interconnectivity signed between the People's Bank of China and the Monetary Authority of Macao on October 13, 2025, regarding it as a significant breakthrough for Macao in the field of cross-border payments. This will establish an efficient, secure, and convenient cross-border payment network, enabling residents of both areas to use their respective e-wallets for retail payments as if they were in their home region. Mr. Lo explained the complementary roles of Hong Kong and Macao in jointly promoting financial integration in the GBA, providing a deep analysis of their unique positions within the region. Hong Kong serves as an international-level "bridgehead" and "firewall," functioning as a capital converter, offshore Renminbi center, and risk and capital management hub. Macao, positioned as a specialized "service zone" and "new platform," leverages its ties with Portuguese-speaking countries to build a financial service center between China and these nations, while also acting as a supplementary node for cross-border finance on the western side of the GBA, actively developing wealth management and cross-border bond pilot programs.

Mr. Lo further explored the future development directions and challenges facing cross-border finance in the GBA. Regarding development, he proposed three key areas:

- In Mechanism and Rule Connectivity ("Soft Connectivity"), there is a need to promote the cross-border application of regulatory sandboxes, mutual recognition of rules and standards, and explore a "single pass" system.

- At the level of Market and Product Innovation, existing interconnectivity mechanisms should be deepened, Renminbi-denominated products vigorously developed, and distinctive financial sectors cultivated.

- In the realm of Infrastructure and Technology Empowerment ("Hard Connectivity"), it is essential to build trusted channels for cross-border data flow, modernize payment and clearing systems, and establish a cross-border digital identity authentication system.

However, Mr. Lo also pointed out multiple current challenges:

- At the Institutional and Regulatory level, the differences between the "Two Systems" present a fundamental challenge, and the efficiency of regulatory coordination still needs improvement.

- On the Technical and Operational level, barriers to cross-border data flow exist, and the interconnectivity of financial infrastructure needs strengthening.

- In terms of Markets and Products, challenges include product mutual recognition, differing market demands, and talent and qualification barriers.

- Regarding Macro Risks, it is necessary to properly address cross-border risk contagion and the impacts of geopolitical and external environmental uncertainties.

Following this, Regional Director, Ms. Joana Leong, provided a detailed introduction to the development history and innovative services of Well Link Bank since its establishment in 1996, the bank has continuously expanded its service network, currently operating 7 branches in Macao. The bank's total assets have now reached MOP 34.7 billion, serving over 80,000 customers, demonstrating steady development. Ms. Leong highlighted key product milestones, including basic services such as debit cards, credit cards, mobile banking, and safe deposit boxes, as well as innovative businesses like securities services, fast payment, and online account opening. Furthermore, Well Link Bank has opened Macao's first barrier-free bank in Taipa, showcasing its commitment to community service.

The participating students showed strong interest in the development trends of Macao's financial industry and banking practices, actively asking questions during the exchange on topics such as the development direction of GBA cross-border finance, the application of fintech, and business expansion strategies. The bank's senior executives provided professional and detailed responses. This visit not only provided the students with a deeper understanding of GBA cross-border financial policies and practical banking operations but also allowed them to witness the outstanding achievements of a local bank in financial innovation and service optimization. The faculty and students of the Faculty of Finance sincerely thank Well Link Bank for the meticulous arrangements and professional sharing, which provided a valuable learning opportunity. The students look forward to more exchange activities in the future, believing these experiences will significantly contribute to their professional growth and development in the field of finance.