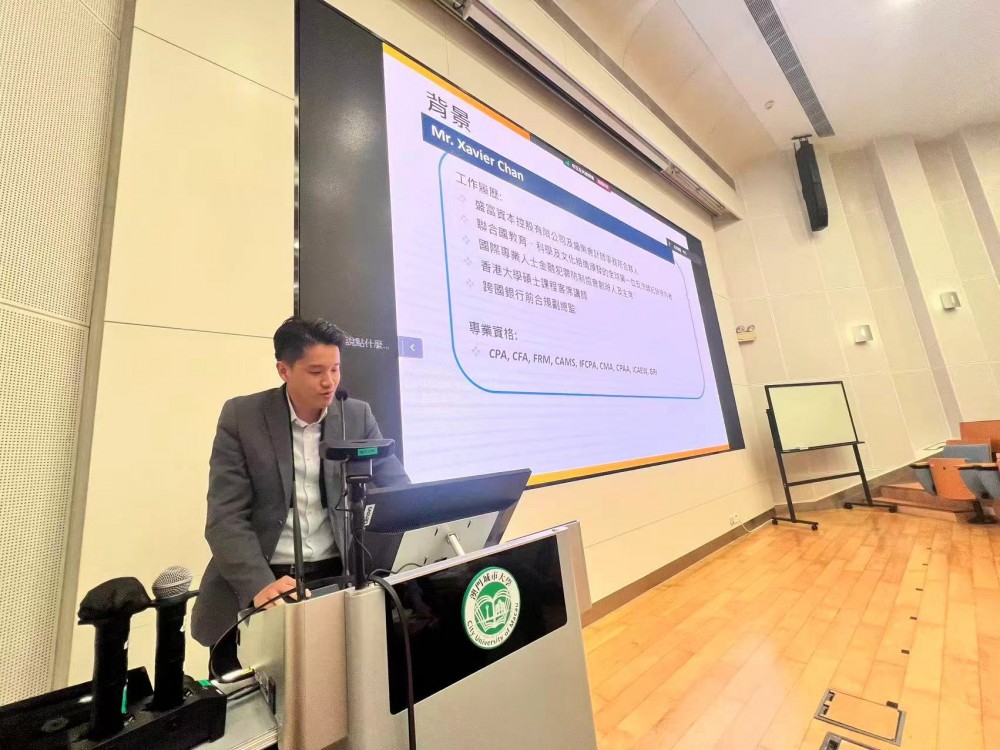

On October 9, 2025, the Faculty of Finance of City University of Macau held a finance seminar at Ho Yin Conference Center on Taipa Campus. The seminar featured Mr. Xavier Chan, Partner of Shing Full Capital Holdings Limited and Synloc CPA Limited, was invited as the keynote speaker. The seminar focused on the theme "Financial Leasing from the Perspective of Accounting and Taxation". Distinguished guests included Instructor Mr. Chan and Teaching Assistant Ms. Li Xiaoyan from the Faculty of Finance's Financing Leasing course at City University of Macau.

Mr. Xavier Chan began by introducing the tax regulations applicable to businesses in leasing arrangements. He first explained the new leasing standards under IFRS 16, their significance, and their impact on financial statements. He discussed the different accounting and tax treatments for lessees and lessors in finance leases versus operating leases. A finance lease primarily refers to a lease agreement that transfers substantially all the risks and rewards incidental to ownership of the leased asset, often involving a transfer of title or a bargain purchase option. An operating lease, on the other hand, refers to a lease agreement where the lessor effectively retains the significant risks and rewards of ownership, without the transfer of control. Mr. Xavier Chan elaborated on key examples from the perspectives of both the lessee and the lessor: including the lessee's recognition of assets and liabilities and the reduction of the lease liability; and the lessor's recognition of lease income and the presentation of the related asset. He also explained the eight important indicators used to define a finance lease, along with key definitions.

In the second half of the seminar, Mr. Xavier Chan supplemented the discussion with accounting knowledge related to finance leases. Tax considerations primarily involve cost-related tax deductions and the taxability of income. Cost tax deductions include arrangements for lease interest and related fees, while taxable income involves potential tax incentives. Cost tax deductions can help businesses reduce their overall costs. Regarding taxable income, certain lease contracts might qualify for exemptions, reductions, or deferrals based on specific conditions. These tax considerations can significantly impact a company's financial position and tax burden. Therefore, when structuring lease arrangements, companies should carefully consider the relevant tax factors to achieve optimal outcomes.

The seminar concluded with a Q&A session, where the speaker addressed how to link accounting treatments with tax practices and provided guidance on positioning oneself for a career path in the finance industry. The faculty and students of the Faculty of Finance sincerely thank Mr. Xavier Chan for his insightful sharing, which provided students with a deeper understanding of the key corporate tax points and accounting treatment standards for financing leases. The students are already looking forward to the next finance seminar.