On October 9, 2025, the Faculty of Finance of City University of Macau held a finance seminar at Ho Yin Conference Center on Taipa Campus. The seminar featured Mr. Vincent Cai, Executive Vice President, General Manager of Macau Branch, was invited as the keynote speaker. The seminar focused on the theme " Wealth Management in Macau." Distinguished guests included Dean Adrian Cheung and Associate Dean Eva Khong of the Faculty of Finance.

Executive Vice President Vincent Cai graduated from the MBA program at Hitotsubashi University in Japan and the EMBA program at Tsinghua University's PBC School of Finance. He was awarded the "Young Leaders" scholarship by the Japanese government and boasts over 25 years of experience in the financial industry. He previously worked at the Agricultural Bank of China for 18 years, serving in various positions such as branch manager at the Shenzhen branch, deputy general manager of the marketing department at the head office's private banking department, and general manager of the business management department at the private banking department. He also formerly served as Executive Director and Deputy President of Well Link Bank (Macau).

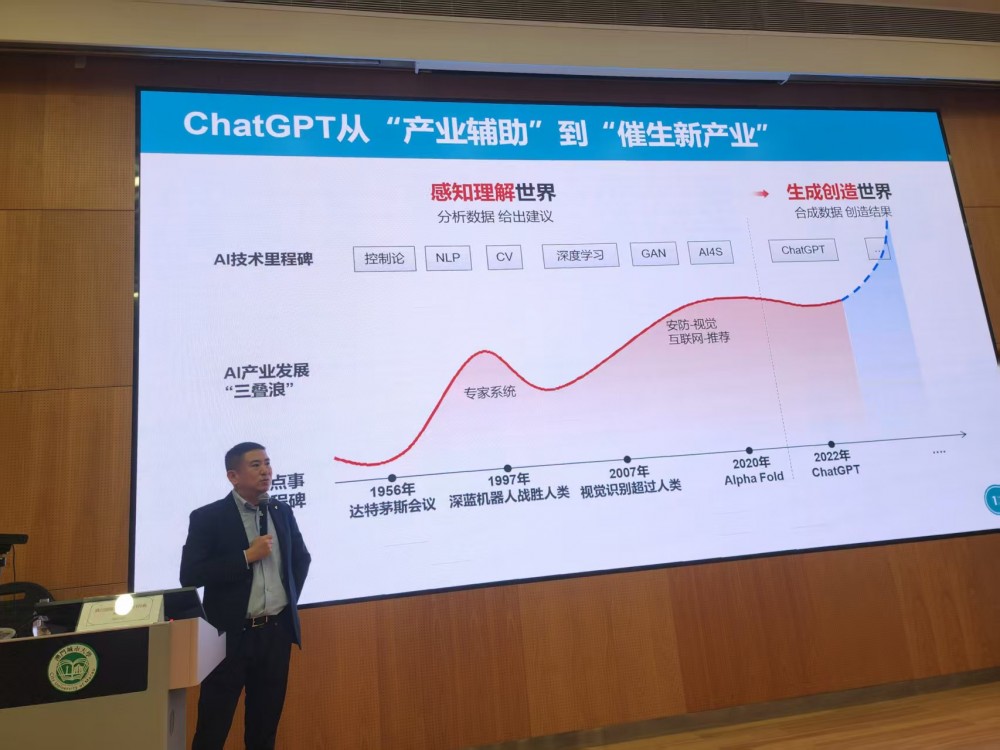

During the seminar, Mr. Cai shared his insights from four key dimensions: the creation and distribution of wealth, the Macao wealth management market, asset allocation and wealth planning, and Macao's financial industry in the global context. He provided an in-depth analysis of Macao's positioning and future direction in the field of wealth management. Mr. Cai pointed out that wealth creation and distribution are based on business integration, industry benchmarking, initial public offerings (IPOs), and mergers and acquisitions. Regarding long-term corporate value, he emphasized that it depends on industry potential, competitive landscape, and business models. Mr. Cai noted that in recent years, with the rapid development of artificial intelligence technology, Generative AI (AIGC), represented by ChatGPT, is leading a new round of industrial transformation. This technology possesses powerful iterative evolution capabilities, transitioning from its previous role as an "industry auxiliary" to becoming a significant driving force "spawning new industries," creating substantial wealth and employment opportunities for society. The continued development of this technology drives innovation across various sectors, bringing more business opportunities and returns for enterprises and individuals. Simultaneously, Mr. Cai emphasized in his seminar that wealth creation is not only about technological innovation but also requires attention to long-term value and debt cycle management, reminding investors to prioritize asset allocation and risk diversification.

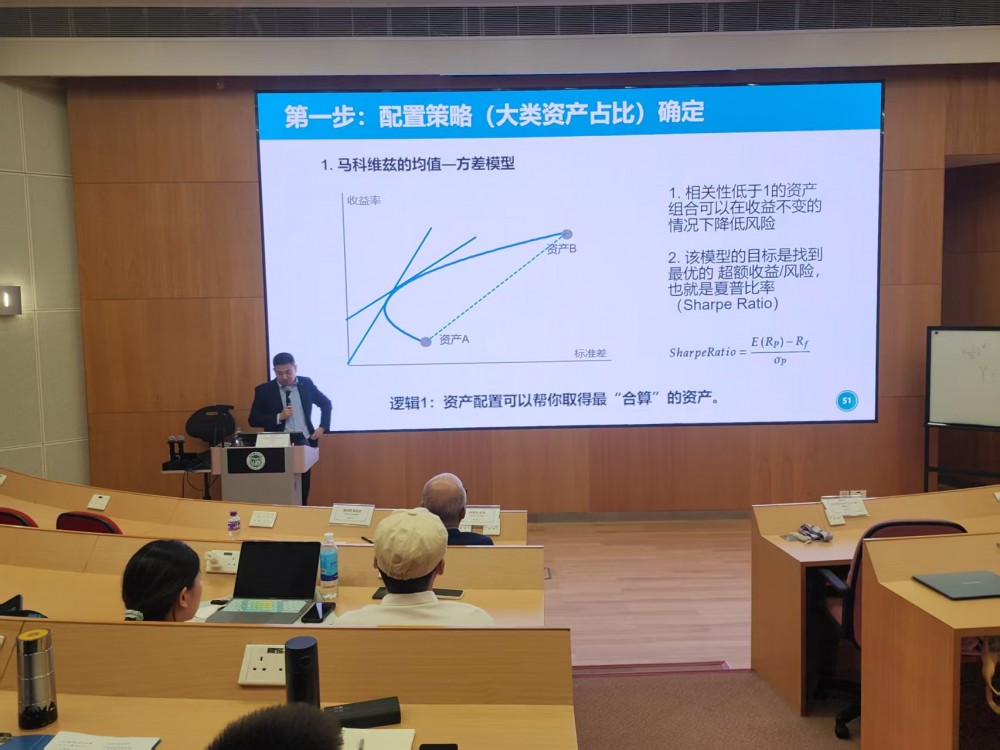

Mr. Cai indicated that Macao's wealth management market is diverse and innovative, offering investors a broader range of choices and development opportunities. In recent years, Macao's wealth management market has experienced vigorous development, attracting numerous international financial institutions to establish a presence. Financial institutions in Macao, including insurance, securities, fund, and banking sectors, provide clients with diverse and highly professional financial products and services. Mr. Cai delved into the importance of asset allocation, detailing four classic models during the lecture: Markowitz's Mean-Variance Model, which emphasizes risk reduction through asset portfolios; the Black-Litterman Model, which combines historical data with professional views; the Capital Asset Pricing Model (CAPM), which distinguishes between systematic and unsystematic risk; and Bridgewater's Dynamic Allocation Model, which involves dynamic adjustments based on multi-institutional research and validation. Mr. Cai emphasized that asset allocation should align with different risk preferences and wealth plans, utilizing intelligent investment strategies to achieve wealth appreciation and preservation goals. Investment advisors and financial institutions play a key role in this process, able to formulate tailored asset allocation and wealth planning solutions based on the specific circumstances of individuals or families, assisting them in achieving financial goals, mitigating risks, and maximizing returns. During the seminar, Mr. Cai mentioned that the Macao government is actively promoting the development of the "Four Major New Industries," encompassing Big Health, Modern Finance, High-Tech, and MICE (Meetings, Incentives, Conventions, and Exhibitions) Commerce and Trade, as well as Culture and Sports. To support industrial development, Macao has launched the "Three Categories of Special Talent Admission Schemes," focusing on attracting High-End Talents, Outstanding Talents, and Advanced Professional Talents, providing talent support for the development of the financial industry.

Macao's wealth management market comprises four main sectors: banking, funds, securities, and insurance. According to data from the Monetary Authority of Macao, as of February 2024, total deposits from residents and non-residents reached MOP 10,460 billion, with resident deposits accounting for 69.2%. The multi-currency distribution highlights Macao's characteristic as an international financial platform with monetary diversity. Macao's banking sector maintains a robust development trend, steadily integrating with global standards and forming a distinctive wealth management ecosystem. With the deepening development of the modern financial industry and the advancement of talent introduction schemes, more diverse and professional asset allocation options are being provided to investors in the region. Mr. Cai also emphasized the transformations and challenges faced by Macao's banking industry in the process of globalization. Leveraging its advantageous geographical location and diverse financial culture, Macao has become an integral part of the international financial market.

Following the seminar, students actively engaged in discussions and exchanged ideas with Mr. Cai, who patiently answered their questions. The faculty and students of the Faculty of Finance once again expressed their gratitude to Mr. Cai for his insightful analysis and experience sharing, stating that it provided new perspectives for future financial academic research and practical financial operations. This lecture allowed students to gain a deeper understanding of asset allocation and wealth planning. The students expressed strong interest and significant benefit from the session, looking forward to further exploration in this field and domain.