To deeply integrate with the teaching for the Finance Elite Cohort of the Faculty of Finance and promote the communication between cohort students of all grades, the Faculty of Finance held “Finance Elite Time: Pursuing a Career in Banking and Finance Industry” in the afternoon of 20 April 2022. Mr. Vincent Wee, Senior Managing Director of Marcuard Heritage (Singapore) Pte Ltd, and Ms. Caroline Kwong, Managing Director of The Global Value Investment Portfolio Management Pte Ltd, were invited to share online their valuable insights with the teachers and students based on their practical work experience. Students in the BAE Finance Elite Cohort of grades 19, 20 and 21 gathered together and communicated in English at the event. Dean Adrian Cheung, Associate Dean Eva Khong, Course Coordinator of Graduate Program Zefu Wu, Course Coordinator of BAE Program Deqin Lin, Associate Professor Shiyan Lou, Assistant Professor Liu Lu, Assistant Professor Lifei Xue, Assistant Professor Bo Yu, Assistant Professor Lamont Yu, Assistant Professor Di Li and Elite Cohort students attended this event together.

In his speech, Dean Adrian Cheung warmly welcomed the participation of the students, especially the grade 19 students. He hoped that through this gathering, they can quickly get together with the seniors of the grades 20 and 21 in Elite Cohort and learn from each other on the way of learning in the future. He then introduced the rundown of the event and pointed out that in order to encourage students to consult more experienced people in the academic and financial industry, the Faculty specially arranged the mentor program. The students are encouraged to communicate with their mentors no matter what difficulties they encounter in their studies or lives, and the mentors will try their best to help them.

Later, Associate Dean Eva Khong expressed her gratitude to the two guest speakers for their support and introduced them to the teachers and students, respectively. Mr. Vincent Wee has a wealth of experience in the banking sector, spanning retail and corporate banking, and treasury. He has close to 40 years’ experience involved in credit, trade finance, cash management, commodity and project financing, and client relationship management. Ms. Caroline Kwong holds a Master of Science in Finance and Accounting, and has extensive experience in investment, fundraising, corporate finance, capital markets and debt restructuring arising from her work experiences in the past.

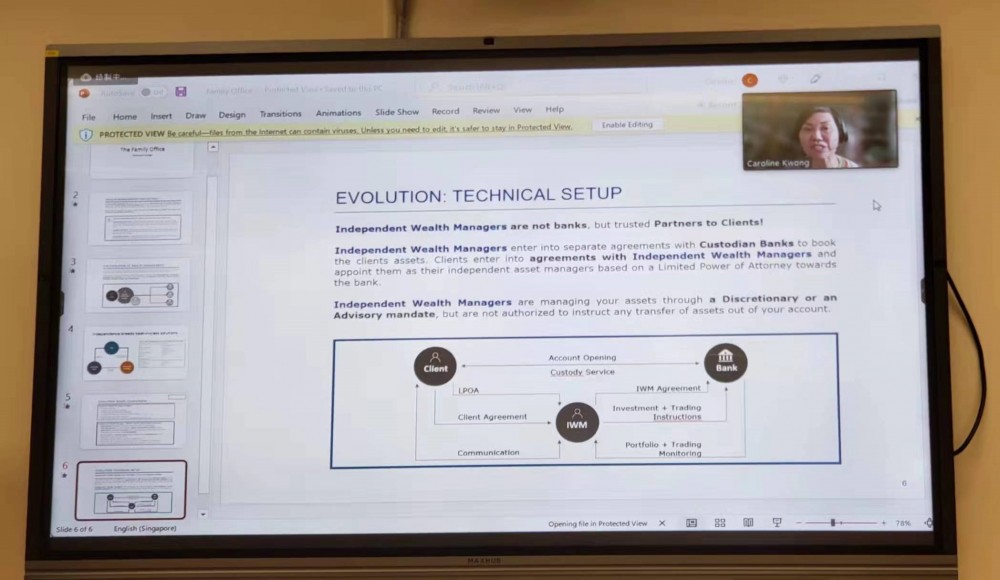

In the sharing section, Mr. Vincent Wee introduced the concept of the Family Office. The Family Office is a very recent development in Asia, which is set up for wealthy families to manage funds. It originated from a wealthy family who needed a more comprehensive approach than what bank can offer, so they form their own family business/office to manage their wealth, not only on financial asset but also family legacy. It is important for the clients to have wealth protection and a more conservative, well-diversified asset allocation to ensure their lasting well-being and social status. Compared to traditional bankers, Independent Wealth Managers are experienced professionals to help clients to achieve their long-term financial and personal objectives which include minimizing the risk of loss, capital protection, and generating returns. Independent Wealth Managers also offer independence, flexibility, alignment of interest with clients, and outstanding personalized one-stop service across multiple custodian banks and jurisdictions. Mr. Wee summarized that Independent Wealth Managers are not banks, but trusted partners to clients, which enter into separate agreements with custodian banks to book the clients’ assets, and the clients enter into agreements with Independent Wealth Managers and appoint them as their independent asset managers based on a limited power of attorney towards the bank.

Ms. Caroline Kwong mentioned that when a family decided to invest for a return, it is all about asset allocation in wealth management terms. In the past, a lot of families with a family business want to preserve the capital to ensure the protection of the family wealth and a steady return every year. Over the last ten to twenty years, the first-generation family members or family founders have passed on wealth to the second or third-generation family members, and businessmen who use technology to start businesses have also created a lot of wealth. They are more inclined to focus on high-risk returns than on the return of safe capital in asset allocation. Due to the transformation of wealth and the change in the mode of how people created wealth, a lot of families and investors are finding ways in which they are willing to take more risks. More and more educated investors want to make sure that wherever they invest their money, they can make an impact and make the world a better place. Ms. Caroline Kwong then introduced The Global Value Investment Portfolio Management Pte Ltd. (GVIP). GVIP was formed to nurture young and dynamic companies around the world that focus on companies with deep technologies that seek to bring about an inclusive, sustainable and resilient future for all. GVIP invests primarily in businesses that enable the building of an eco-friendly habitat based on a circular economy, in areas including renewable energy, food and agri-tech, clean resources and healthcare.

Lastly, Assistant Professor Derick Lin introduced the features of the Finance Elite Cohort mentorship program and its help to the students. Each student was assigned to a mentor of the Faculty, who will guide the students in the coming four years of study. Later, all students and their mentors discussed in English in groups to promote communication between the students of three grades and with the mentors. The Faculty also prepared refreshments and the students and mentors further communicated with each other and enjoyed their gathering time.