On 30 March 2023, the Faculty of Finance of the City University of Macau held the Finance Seminar Series [23] at Golden Dragon Campus. Dr. Ivan Fong, member of the Doctoral Think Tank of Macau, a postdoctoral researcher of Soochow University, a researcher of the Constitution and Basic Law Research Center of Shenzhen University, and Director of the Macau Legal Science Association, was invited to deliver a speech titled “Introduction to Mergers and Acquisitions Law”.

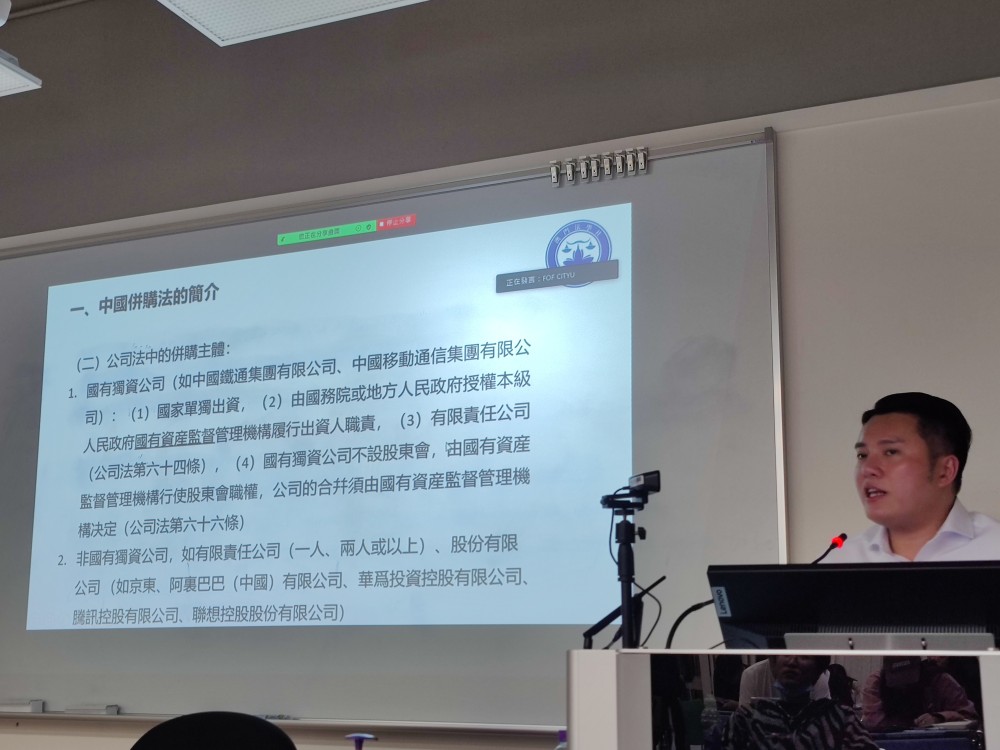

In the seminar, Dr. Fong introduced the outline of China's Merger and Acquisition (M&A) regulation and the main content of M&A in the Company law. He pointed out that it is generally preferred to establish limited liability companies, and to establish unlimited liability companies is rarely chosen. He also briefly explained the meaning of corporate M&A: two or more companies change into one company according to law. He gave an extended description of the new merger and then described the entire merger process, which can be divided into five steps, including making a decision or resolution to merge, entering into a merger agreement, preparing a balance sheet and a list of assets, notifying creditors and observing the principle of the disclosure. He then explained the legal consequences of mergers and shared two classic takeover cases, including the battle of Vanke and the backdoor listing of SF Express.

Dr. Fong then explained clearly the steps of the Macau M&A Law. First, the M&A plan was drawn up and monitored, then it went to the shareholders' meeting, and was published in the government gazette, and lastly, the merger was registered. Dr. Fong analyzed the differences between China’s M&A regulation and Macau M&A law. The merger procedure is different. Compared with Macau, the Mainland has a procedure of "preparation of Statement of Responsibility and List of Assets". However, Macau Commercial Law regards this as a sub-item of "preparation of merger plan" rather than an independent procedure. As for the subsequent claims and debts of the surviving or newly established company after merger, Macau Commercial Law stipulates that shareholders or creditors may apply to the court to appoint a special agent to handle the relevant affairs, but the Company Law of China does not have such provisions. Creditors of a company have different periods in which to claim their claims. The period of claim of Macau is shorter than that of mainland creditors.

After the sharing, students actively posed various questions, and Dr. Fong answered in detail. Through this seminar, the students understood the different legal mechanisms in different regions and the different ways of applying laws. Most importantly, the students had a deeper impression of the process of M&A.