On 15th January 2026, the Faculty of Finance of City University of Macau held a finance seminar, Luso Bank Financial Forum at Ho Yin Conference Center in Taipa Campus. The seminar featured Dr. Ren Tao, Director of the Economic Research Center of Luso International Banking, was invited as the keynote speaker. The seminar focused on the theme: “Review of the Macroeconomic Situation in 2025 and Outlook for 2026.” Distinguished guests included Dean Adrian Cheung and Associate Dean Eva Khong of the Faculty of Finance.

Dr. Ren, Director of the Economic Research Center of Luso International Banking, a distinguished researcher appointed by the National Institution for Finance and Development and a Senior Special Researcher at the Shanghai Finance & Development Laboratory. He has been invited multiple times to lecture for regulatory entities. He has published over 30 articles in various journals such as "Statistical Research" and "Financial Expo" and operates public accounts "Dr. Ren's Macro Talk" and " Bozhan Think Tank", focusing on research in macroeconomic finance, industry and policy, commercial bank balance sheet management, and risk management, with more than 300,000 fans following.

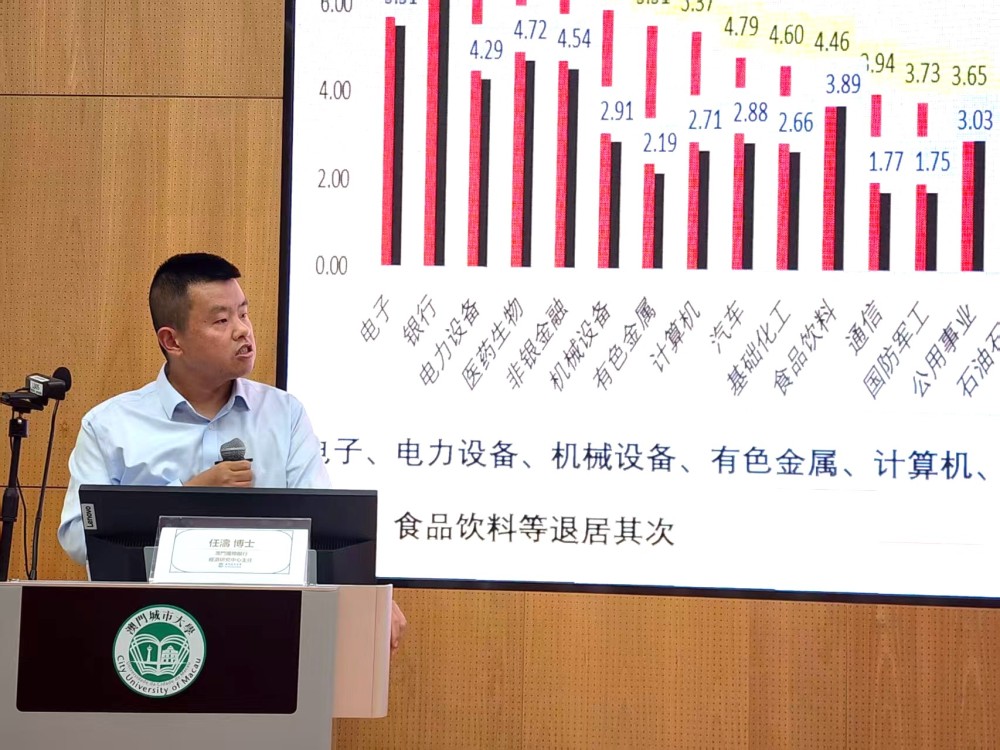

During the seminar, Dr. Ren Tao systematically reviewed the performance of global financial markets in 2025 and provided a forward-looking outlook on economic trends for 2026. He pointed out that in the past year, global stock, bond, and foreign exchange markets exhibited significant structural divergence. Despite complex domestic and international circumstances, the Chinese economy is expected to show a "lower in the first, higher in the second" trajectory in 2026. Dr. Ren analyzed the stock, bond, and foreign exchange markets separately. Citing data, he indicated that although U.S. tariff policies in 2025 introduced uncertainty into the trade environment, global stock markets generally rose, with several emerging market and technology stock indices increasing by over 50%. The U.S. Dollar Index declined, while non-U.S. currencies generally appreciated, reflecting the market's gradual digestion of policy shocks as it adapts to a new normal. Dr. Ren mentioned that the "24th September Moment" (the "24th September 2024" press conference, where China's central bank, top securities regulator and financial regulator announced a raft of monetary stimulus, property market support and capital market strengthening measures to boost the country's high-quality economic development) trend continues in the Chinese market, with significant shifts in market trading structure. Sectors such as electronics, power equipment, machinery, and defense have become the main focus of capital flows, while traditional industries like banking and food & beverages have relatively receded, indicating a deepening of industrial transformation and capital reallocation.

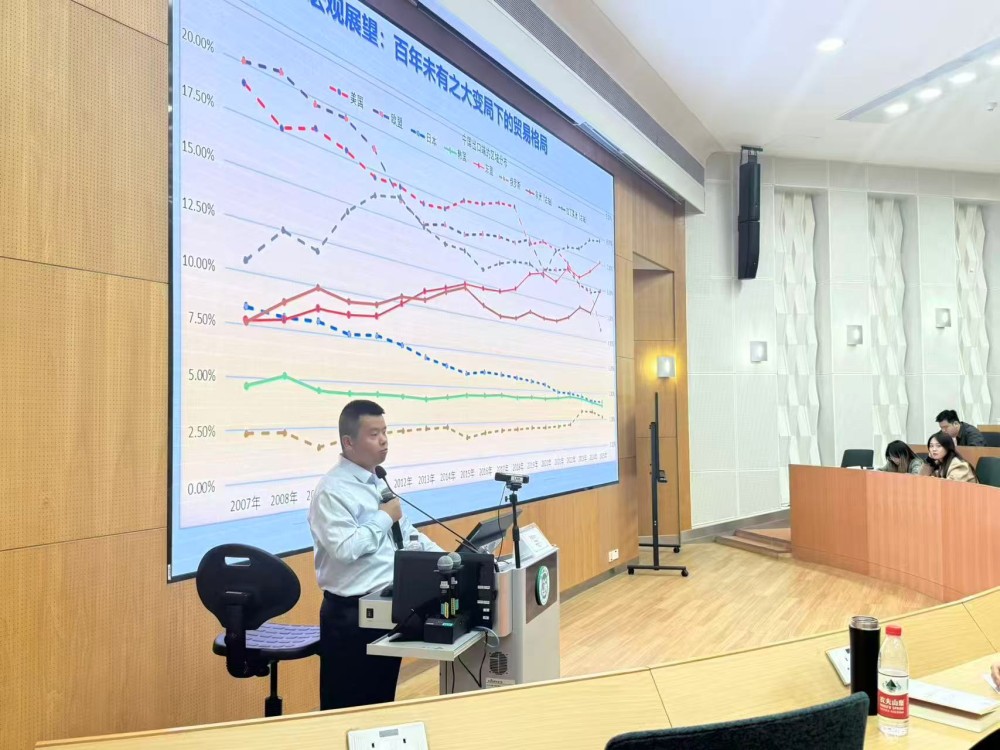

Dr. Ren anticipates that the Chinese economy in 2026 will exhibit a "lower in the first, higher in the second" pattern, with economic momentum expected to gradually strengthen in the second half of the year. However, he emphasized that expectations for macroeconomic policy should not be overly high: the intensity of monetary policy in 2025 was actually the lowest since 2022, and unless economic growth and inflation recovery face greater-than-expected pressure, significant policy easing in 2026 is unlikely. Based on data trends, Dr. Ren noted that in terms of the global landscape, amid unprecedented changes unseen in a century, trade restructuring and industrial chain adjustments will continue to be key variables affecting the economic direction of various countries. Markets will maintain characteristics of high volatility and high divergence, requiring investors to pay closer attention to structural opportunities and long-term trends. In a complex and ever-changing domestic and international environment, rational expectations, prudent positioning, and risk management will be crucial for navigating the markets in 2026.

The faculty and students of the Faculty of Finance sincerely thank Dr. Ren Tao for his insightful presentation. Through this seminar, they gained important guidance and inspiration for understanding future economic development, and many expressed that they benefited greatly. The Faculty of Finance will continue to organize such events to further enhance students' integration of financial theory and practice, laying a solid foundation for their applied financial knowledge.