On April 18, 2024, the Financial Seminar Series [23] organized by the Faculty of Finance at the City University of Macau was held at the Ho Yin Convention Centre on Taipa Campus. The seminar featured Dr. Chu Chin Lam, Chairman of Macau Asset Management Association and Visiting Professor at the Faculty of Finance, as the keynote speaker. His presentation was titled "The Development of Wealth Management in Modern Financial Industry in 2024." Guests attending the seminar included President Mr. Miguel Lao, Supervisor Mr. Stanley Ho, Vice President Miss Kaman Lai, General Affairs Secretary Miss Kimi Hui of Macau Asset Management Association, and Senior Insurance Executive Miss Miki Lei, as well as Dean Adrian Cheung and Associate Dean Eva Khong of the Faculty of Finance, City University of Macau.

At the beginning of the seminar, Dr. Chu shared the latest developments in China's financial industry and the Guangdong-Hong Kong-Macau Greater Bay Area. According to data from the National Financial Regulatory Administration, by the end of December 2023, China's total banking assets reached 417.3 trillion yuan, and the total assets of the insurance industry were 29.96 trillion yuan, both ranking among the top globally. Despite global economic growth being only 2.6% in 2023, China's economy performed strongly with a GDP growth rate of 5.2%, exceeding expectations. In the first quarter of this year, China's GDP growth rate reached 5.3%, further proving its status as a crucial engine for global economic growth.

Regarding the development of the Guangdong-Hong Kong-Macau Greater Bay Area, Dr. Chu mentioned that 2024 marks the fifth anniversary of the implementation of the development plan for the Greater Bay Area. The economic performance of the "9+2" city cluster has been remarkable. From 2019 to 2023, the GDP of the Greater Bay Area increased from approximately 11.5 trillion yuan to about 14 trillion yuan, surpassing economies like Australia and Korea, approaching Italy and Canada among the world's top ten economies. Both Shenzhen and Guangzhou have GDPs exceeding 3 trillion yuan, while Foshan and Dongguan also surpassed 1 trillion yuan.

When discussing the development of wealth management services in the Greater Bay Area, Dr. Chu cited data from Hurun Report's 2023 China High Net Worth Family Management Report, indicating that the Guangdong region accounts for about 300,000 high-net-worth families with assets worth several millions of yuan, with cities like Shenzhen, Guangzhou, Foshan, and Dongguan accounting for a more significant proportion. He believes that the vast market size of the Greater Bay Area and demand for professional services such as risk and wealth management provide broad opportunities for the development of insurance and wealth management products. Notably, with the increasing interest of mainland residents in overseas insurance products, new premiums paid by mainland residents to Hong Kong reached HK$59 billion in 2023, accounting for 32.6% of Hong Kong's total premiums. In Macau, according to data from the Monetary Authority of Macao, new individual life insurance premiums from mainland residents accounted for about 57% in 2023.

Dr. Chu also mentioned that Cross-Border Wealth Management Connect Scheme 2.0 was officially implemented in February 2024, increasing the individual investor limit to 3 million yuan and expanding the range of investable products. According to data from the People's Bank of China Guangdong branch, by the end of October 2023, over 69,200 investors participated in the pilot program, involving more than 12.8 billion yuan. This policy will further promote cross-border capital flows and positively influence the future development of Macau's wealth management business.

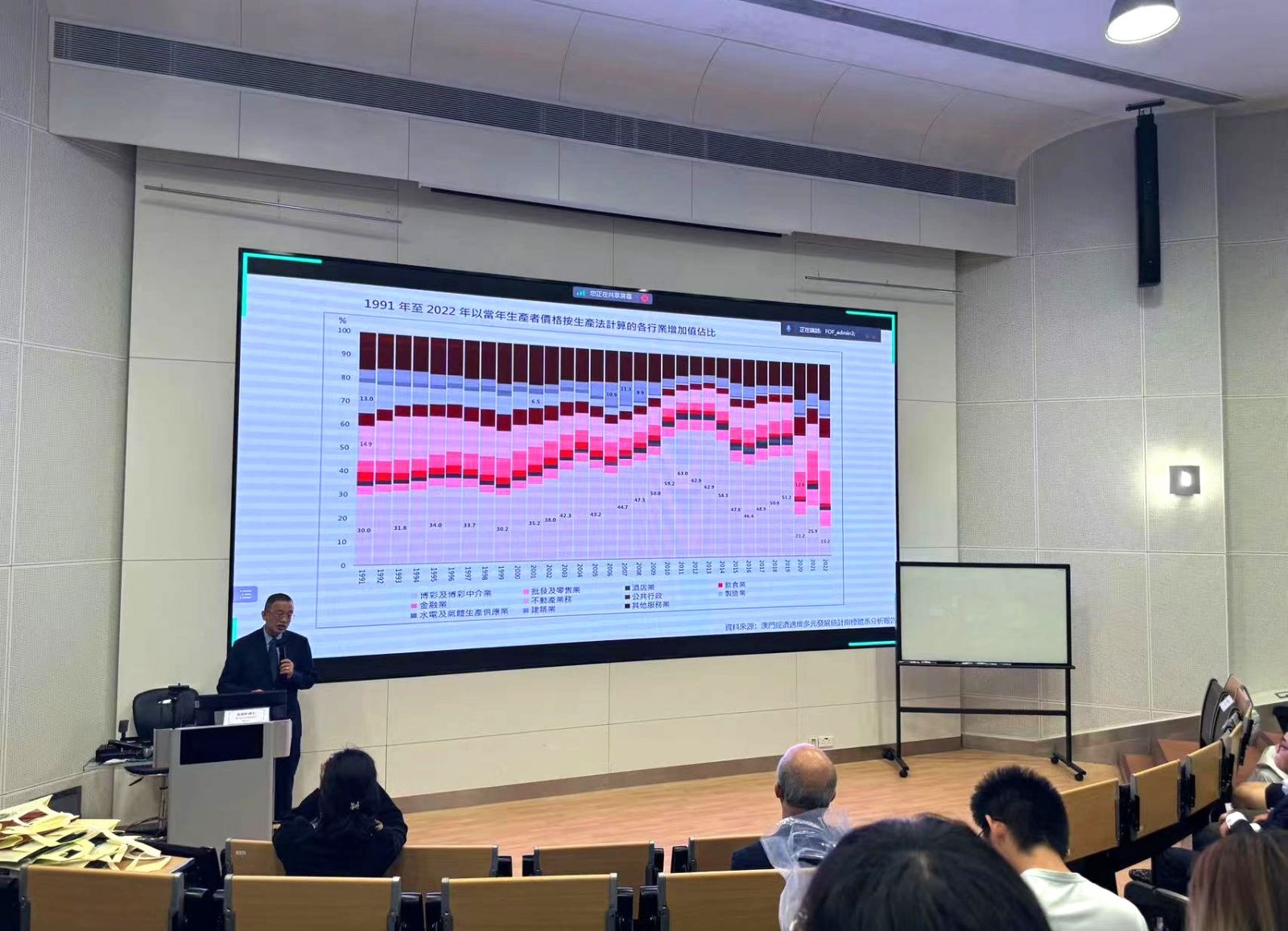

Additionally, Dr. Chu discussed the "1+4" strategy for moderately diversified economic development promoted by the Macao SAR government. According to data from the Monetary Authority of Macao, by the end of 2022, there were about 455,000 wealth management accounts in Macau banks, with a portfolio market value of MOP 207.7 billion. Among these, accounts held by Macau residents (including the public sector) accounted for up to 93.4%, demonstrating strong local demand for wealth management services. Dr. Chu emphasized that in promoting the development of modern financial industries, Macau should fully leverage opportunities in the Guangdong-Hong Kong-Macau Greater Bay Area, enhance expansion in wealth management and talent training to enhance competitiveness in the international financial market.

This seminar provided valuable industry information and market analysis for students and faculty at City University of Macau, contributing to the continuous healthy development of Macau's financial industry. With the deepening cooperation in the Guangdong-Hong Kong-Macau Greater Bay Area and the implementation of policies like Cross-boundary Wealth Management Connect Scheme, Macau's status as an international financial center will be further solidified, contributing more to the economic development of the region and the globe. Students benefited greatly from the seminar. The Faculty of Finance at City University of Macau extended heartfelt thanks to Dr. Chu Chin Lam, Chairman of Macau Asset Management Association and Visiting Professor at the Faculty of Finance, for his insightful sharing. The Faculty of Finance will continue to organize such events, focusing on nurturing modern financial talents.