On February 10, 2026, the Faculty of Finance at City University of Macau held a finance seminar at Golden Dragon Campus, Macau. The seminar featured Mr. Bernard Li, Macau Office Leader of PricewaterhouseCoopers, was invited as the keynote speaker. The seminar focused on the theme " Resilient Growth, Reshaping Value: Q4 2025 Economic Insights and Business Outlook of CEOs and Investors." Distinguished guests included Dean Adrian Cheung and Associate Dean Eva Khong of the Faculty of Finance.

Mr. Bernard Li is currently the Macau Office Leader of PwC and also an Audit and Assurance Services Partner for Zhuhai and Hong Kong firms. He graduated from The Chinese University of Hong Kong and joined PwC Hong Kong's Audit department in 2001. From 2007 to 2009, he served as an Audit Manager at PwC London. Mr. Li is a Certified Public Accountant (Practising) in Macau and Hong Kong, a Fellow of the Hong Kong Institute of Certified Public Accountants (HKICPA), a Fellow of the Association of Chartered Certified Accountants (ACCA), and a Fellow of CPA Australia. He was appointed as a member of the Supplemental Income Tax Assessment Committee by the Macau Financial Services Bureau in 2023 and 2026, and has been a member of the Evaluation Committee for the SME Credit Guarantee Scheme appointed by the Macau Economic and Technological Development Bureau since 2024. Mr. Li is actively involved in community service, currently serving as Vice President and Member of the Financial Development Committee of the Guangdong-Macau Association of Industry and Commerce, Vice President and Member of the Portuguese-Speaking Countries Advisory Centre Committee of the Macau Chamber of Commerce and Industry, and Executive Director of the Association of Chong Hang Intellectual Elites.

During the seminar, Mr. Li pointed out that the global economy in 2025 exhibited "mediocre growth," with slowing momentum and diverging trends among major economies. The Asia-Pacific region and "Global South" economies remained the core drivers supporting global growth. However, US tariff policies, trade protectionism, and geopolitical factors added uncertainty to global trade and investment. Notably, investment in the field of artificial intelligence has become a significant engine driving global economic growth.

China's full-year Gross Domestic Product (GDP) for 2025 exceeded RMB140 trillion, growing by 5.0% and successfully meeting the expected target. The growth rate for the fourth quarter stood at 4.5%. The industrial structure continued to optimize, with the tertiary sector contributing 63.2% to GDP, becoming the core engine. The consumer market showed a dual-wheel drive from services consumption and upgraded product categories. Exports continued to strengthen, driven by the electronics industry chain, mechanical and electrical products, and high-tech products. Regarding macro policies, the Central Economic Work Conference outlined the blueprint for the start of the 15th Five-Year Plan, focusing on expanding domestic demand, innovation-driven development, reform and opening-up, and emphasizing "stabilizing employment, enterprises, markets, and expectations." Amidst changing domestic and international environments, a clear trend of Chinese enterprises expanding overseas is evident, moving from exporting goods towards a new phase of exporting technology, services, and brands. However, this also requires systematically addressing challenges related to geopolitics and localized operations. On another front, China has achieved globally recognized hard-core advantages in the field of quantum technology, securing leading results in quantum communication, quantum computing, and quantum precision measurement. It holds the world's largest number of patents and possesses strong capabilities for engineering implementation, making the quantum industry the top priority among the six future industries outlined in the 15th Five-Year Plan.

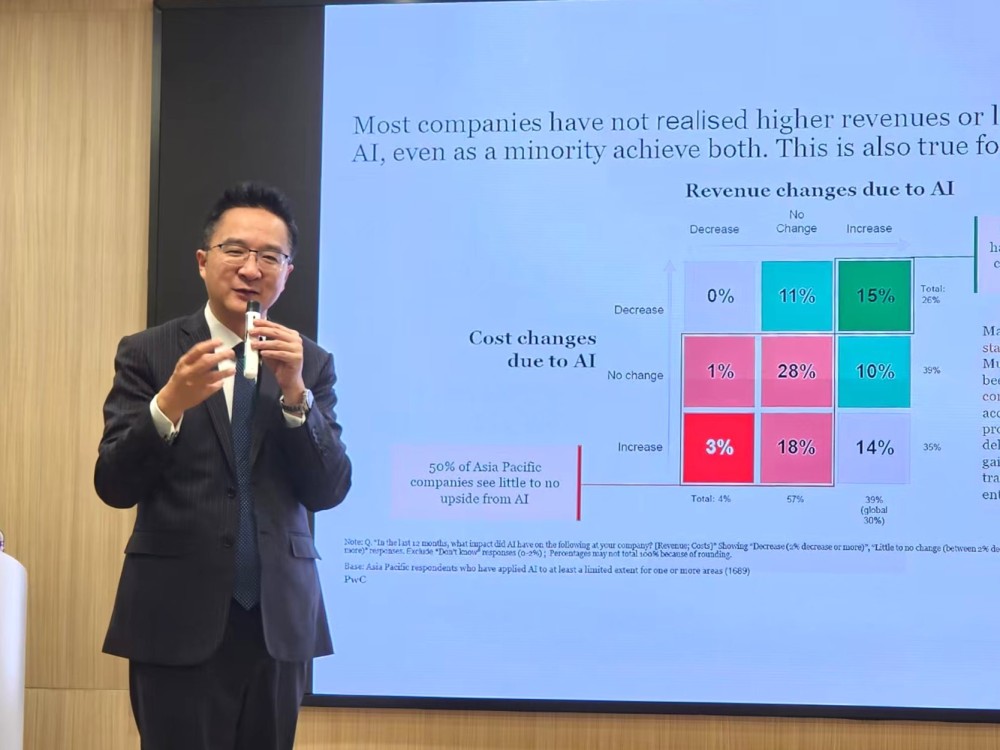

Mr. Li further elaborated that the AI industry has moved from a "technology race" to a "value realization" stage. He cited the successful Hong Kong listing of Beijing Zhipu Huazhang Technology Co., Ltd., known as the "world's first major AI model stock," marking an industry milestone. AI technology is profoundly reshaping various sectors, with specific policy support and application scenarios being implemented in fields such as government affairs, healthcare, transportation, energy, and manufacturing. According to PwC's 29th Global CEO Survey, 39% of CEOs in the Asia-Pacific region reported that AI has already generated additional revenue in the past 12 months, leading the global average. Mr. Li also highlighted that accounting and auditing are entering a new AI era. Facing the wave of AI, the accounting and auditing profession is undergoing profound transformation. PwC has introduced the Next Generation Audit (NGA) model, characterized by being "human-led, data-driven, and AI-augmented." Through tools like AI agents, up to 90% time savings can be achieved in key process steps, allowing teams to redirect more time towards analytical insights. The finance function is shifting from transaction processing to insight generation. Furthermore, the governance framework for Responsible AI in the finance domain, encompassing data integrity, source verification, etc., is crucial for ensuring the reliability and compliance of financial reporting.

During the Q&A session, Mr. Li engaged in active interaction with the students, who asked questions enthusiastically. The seminar provided multi-faceted perspectives covering macroeconomics, industry frontiers, and professional transformation, guiding students to contemplate the current status and future of the financial field from various angles. This seminar not only deepened the faculty and students' understanding of the financial industry but also strengthened the integration of academia and practice. Faculty and students of the Finance Faculty expressed that they greatly benefited from the session, once again thanking Mr. Li for his insightful analysis and experience sharing, which provided a valuable learning opportunity for the students.